Many consider data as the new oil of the digital era. Like oil, when processed, analyzed, and utilized efficiently, data will become even more valuable. In 2020 alone, there were 44 zettabytes of data created worldwide. That’s about 1.7 megabytes of data generated per second for every Internet user in the world.1

Insurers have historically collected massive amounts of data. Today, as more insurers move online to interact with consumers (personal and commercial), the volume of available insurance data is increasing exponentially. Add in the new data being unearthed from social media and other sources such as the Internet of Things (IoT) - appliances, computers, buildings, and equipment- and all this data becomes impossible to manage manually. Thousands of unfiltered, uncategorized data points around underwriting commercial property risks, for example, are useless, unless the data offers P&C insurers actionable insights into underwriting commercial property risks. That’s where the new wave of tech trends such as AI (artificial intelligence), ML (machine learning), and Predictive/Data Analytics are transforming insurance.

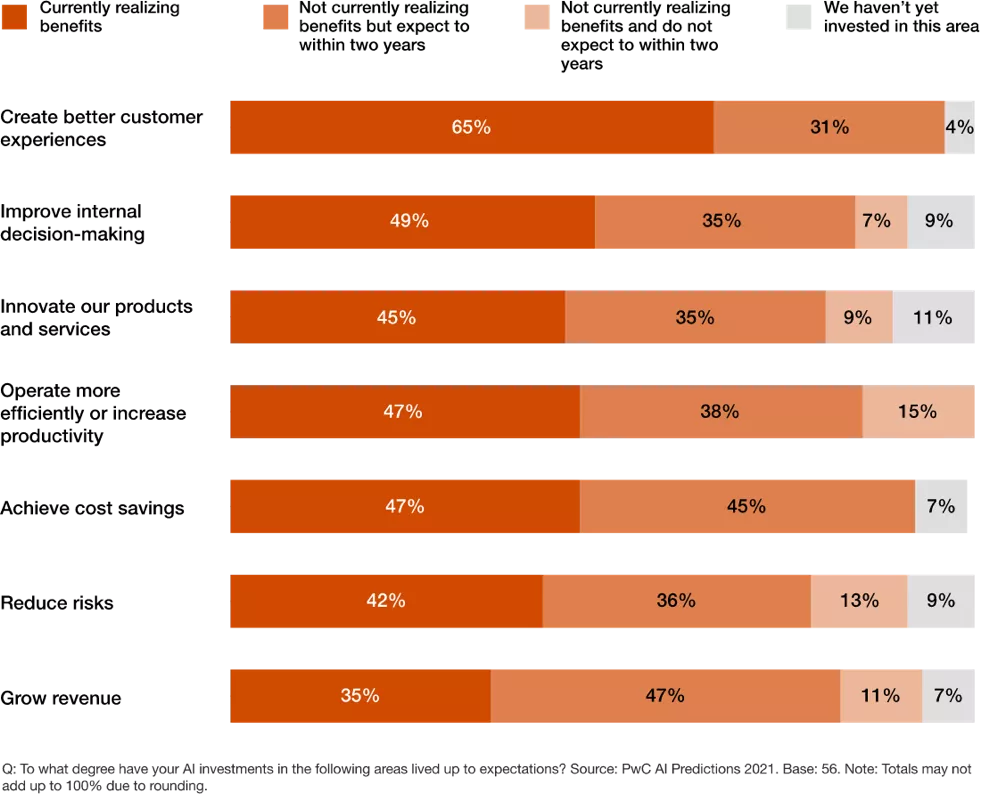

In a 2021 PWC survey of US insurers, a quarter of the insurers reported accelerating plans to implement artificial intelligence (AI), up from 18% in 2020. Another 54% of the insurers were heading there fast.2 Among insurers who invested in AI, two-thirds said that one of the top benefits of AI was improving the customer experience (CX). Beyond the customer experience, half said that AI investments improved internal decision-making. This was closely followed by improving decision-making, speeding up product innovation, creating more efficient operations, increasing productivity, offering cost savings, and reducing risks. One-third reported revenue growth.

Where AI investments are paying off for insurance companies

Here’s what AI can do for P&C insurers and MGAs

AI adoption is growing faster than ever because of the massive proliferation of data and the maturity of cloud processing and computing power. AI benefits to P&C insurers and MGAs are enormous. AI-powered applications enhance customer service, maximize sales, sharpen cybersecurity, perfect supply chains, free up workers from mundane tasks, improve existing products, and point the way to new products. Specifically, AI:

Extracts information quickly and accurately from data in paper or electronic formats. It reads stacks of paper and can pick out specific terms such as fee structures, exclusions, and termination clauses, making valuable information available quickly.

Using natural language, AI can interpret, understand and act on data. This enables chatbots to have a conversation with people. Computers can be fed examples of text chats, helping the computer learn how to communicate more effectively with people. This enables insurers to develop online applications that the consumer can fill out without human intervention, eliminating bottlenecks in online applications.

Claims Management is where AI really proves its worth. During the pandemic when in-person claims adjusting wasn’t possible, insurers combined chatbot technology in various stages of the claim handling process to enable AI assessment of the damage; predict repair costs – using historical data, sensors, and images - to settle basic claims. Beyond claims adjusting, AI’s computer vision can observe machinery or infrastructure and advise on performance and maintenance.

AI also turns dumb sensors into smart sensors by taking measurements of information about vibration, temperature, and sound. This supports predictive maintenance for machinery and optimizes climate controls to cut energy costs as well as help drones and cars drive themselves.

An interesting agent Interaction function employs AI applications to connect Amazon’s Alexa to consumers who ask questions about insurance and the AI application can provide insurance estimates and connect the consumer to the nearest agent to write coverage if the consumer wants to do that.

On-demand insurance – Another product that surfaced during the pandemic was on-demand insurance. When consumers realized the car in the driveway wasn’t being used, insurers stepped up and created insurance policies that could be turned on or turned off with a single swipe on their phones. Chatbots were incorporated to automate claims processing and enable on-demand insurance coverage for homeowners, renters, and small business owners.

The Next Tech Wave: Enter the Age of Data Science

The new wave of tech trends has a laser-sharp focus on turning data into a powerhouse for P&C insurers and MGAs. The three powerful data science tools. AI (artificial intelligence), ML (machine learning), and Predictive/Data Analytics are positioned to offer P&C insurers and MGAs the best opportunities to transform amazing amounts of data into valuable, actionable insights. Singly or together, these new tech trends are powerful tools that are positioned to transform the insurance business. In future blogs, we will go into more detail about AI’s partners ML and Predictive/Data Analytics.

To learn more about how Origami Risk can help P&C insurers and MGAs harness big data with AI, ML, and predictive analytics, contact us!