Gartner, a leading technology and research company, defines total cost of ownership (TCO) as a “comprehensive assessment of information technology or other costs across enterprise boundaries over time. TCO includes hardware and software acquisition and/or subscription costs, management and support, communication, end-user expenses, and the opportunity cost of downtime, training, and other productivity losses.”1

Choosing between SaaS (software as a service) or on-premises digital solutions is one of the most important decisions P&C insurers can make. Like any purchase, the first thing you think about is the benefits of the purchase and the cost. Numerous methodologies and software tools are available online, but it is not easy to determine TCO. At a minimum, you need to calculate initial costs (outright purchase for on-premises or subscription fee if SaaS). Then you need to determine the cost of internal IT resources, operational, downtime, maintenance, and product costs. Additionally, you’ll want to consider the need for and availability of upgrades and updates, the impact of vendor relationships such as ending support for certain software apps, and other associated costs such as warranties.

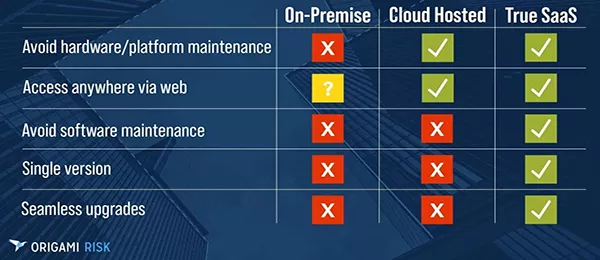

Start by looking at the chart below. The main difference between SaaS and on-premises solutions is how IT assets are managed.

SaaS is a subscription-based model. All the infrastructure required to deliver it – servers, storage, networking, middleware, application software, data storage – are hosted and managed by the SaaS provider. The provider ensures a level of availability, performance, and security as part of a service level agreement. Users pay a monthly or annual fee to use a complete application or platform.

SaaS applications and installations are as simple as having an internet connection and getting a login. Maintenance responsibilities are shifted from your IT department to the SaaS provider, eliminating extra work hours and downtime that might have been necessary to upgrade, update and maintain conventional software. SaaS apps also tend to have a shorter learning curve which means quicker adoption across your workforce and a speed to market that will enhance an insurer’s productivity and profitability.

Compatibility is another great benefit. Conventional software updates can require time and money, and often lead to compatibility issues as not all employees will be on the same version during a rollout of the software. With SaaS, subscribers, everyone logs-on to the already upgraded services and all subscribers are on the same version. You can then turn on, or off features that you wish to use.

With on-premises technology, insurers are responsible for installing, managing, and maintaining the technology housed on-premises. This requires insurer investment in IT resources and other associated costs such as hardware, network, backup systems, human capital, security systems, storage space and regular maintenance costs.

Some insurers like on-premises solutions because it allows them perceived control over their servers, the installation, and maintenance of their technology solutions. This offers them the freedom to implement the solutions according to their requirements and timetable. Those that do not allow third-party hosting due to compliance requirements may also prefer on-premises solutions. If you are considering on-premises options, the first thing to do is to determine if your existing infrastructure meets your current requirements. If it doesn’t, you might struggle to scale storage capacity. A SaaS solution might be a better choice and quite frankly a more secure choice.

Summary

Initially, the advantages of SaaS are economic. The NPV (Net Present Value) of a SaaS subscription is lower than on-premises solutions as it virtually eliminates the costs of maintaining the software.

Insurers with old hardware and enormous amounts of data can benefit from SaaS services because SaaS is designed to reduce costs, and increase efficiency, accessibility, and speed to market. The pricing model for SaaS enables insurers to start small, with modest pricing software subscriptions, and then build up to an enterprise-wide adoption over time as resources become available. Additionally, it’s important to know that SaaS is especially advantageous for small and medium-sized insurers because it offers access to dynamic software solutions that might not otherwise be obtained through conventional purchasing methods.

While using TCO for comparison purposes, it’s important to know that not all costs are recurring and it’s often difficult to predict costs associated with a new vendor. In the end, however, the most critical decision facing insurers isn’t necessarily the cost. The real question is what is the cost of not investing in modern technology? What would the impact be if you choose not to do anything or keep infusing cash into your legacy systems? How do you calculate the value and positive impact technology could make on your company, people, and clients?